Malta has become one of Europe’s most dynamic economies, making Malta Permanent Residency by Investment (RBI) an attractive and convenient option for non-European nationals. In today’s world, more people are seeking alternative residency statuses for better opportunities, stability, and increased mobility. The Malta Permanent Residence Programme (MPRP) helps non-European nationals acquire permanent residency by investment in Malta, offering a lifetime status with numerous benefits, including visa-free travel to Schengen countries. Here, we consolidate essential information about the MPRP.

Why Choose Malta?

Malta offers a unique combination of benefits for those seeking alternative or second residency. Key reasons include:

- Membership in the European Union (EU) and Schengen Area:

-

- Provides freedom of movement within the EU and Schengen Area.

-

- Offers extensive opportunities for investors due to its strategic geographical location.

- Strong and Stable Economy:

-

- Rated A+ by Fitch and A2 by Moody's.

-

- A fast-growing economy with opportunities for non-EU/EEA/Swiss families and businesspersons.

- Quality of Life:

-

- Economic and political stability ensure a high standard of living.

-

- Access to first-class health services and a top educational system through the Malta Permanent Residence Programme.

- Safety and Climate:

-

- Voted the 2nd safest country in the world in 2020.

-

- Known for its exceptional climate.

- Language and Currency:

-

- Member of the Commonwealth, with English as a primary language.

-

- Uses the Euro (€) as its base currency.

With its safety, climate, quality of life, and strategic advantages, Malta offers a compelling case for residency. Why not Malta?

Malta – One of the Safest Countries Globally

In 2020, Malta was recognized as one of the safer countries globally for natural disasters by the World Risk Report. This recognition highlights Malta's minimal exposure to natural hazards and its efficient crisis management capabilities.

The report, developed by the United Nations University's Institute for Environment and Human Security, calculates disaster risk using a comprehensive index based on the following factors:

- Exposure to Natural Hazards: Assessing risks such as earthquakes, storms, floods, droughts, and rising sea levels.

- Susceptibility: Evaluating the resilience of public infrastructure, housing conditions, nutrition, and economic frameworks.

- Coping Capacities: Examining access to medical services, material protection, governance, warning systems, and social networks.

- Adaptive Capacities: Gauging preparedness for climate change and future natural disasters.

Malta's favorable ranking not only underscores its geographical advantage but also its robust infrastructure and adaptive policies. This makes the country a highly attractive destination for individuals and families seeking a safe and secure environment.

Suggested Reading: What is it like living in Malta?

Benefits of Permanent Residency in Malta

Family Security

- Live in one of the world’s safest countries according to the World Risk Report.

- Access leading healthcare institutions.

- Provide world-class education for children.

- Retain lifetime permanent residency status for dependents, even after they reach adulthood.

- Security and stability for you and your family in the event of instability in your native country.

- Confidentiality ensured as names of residents are not published.

Settlement Benefits

- Reside, settle, and stay in Malta indefinitely.

- Experience a Mediterranean lifestyle with warm summers and mild winters.

- Enjoy a pollution-free environment and affordable living standards.

- Invest in a stable and profitable real estate market.

Travel Benefits

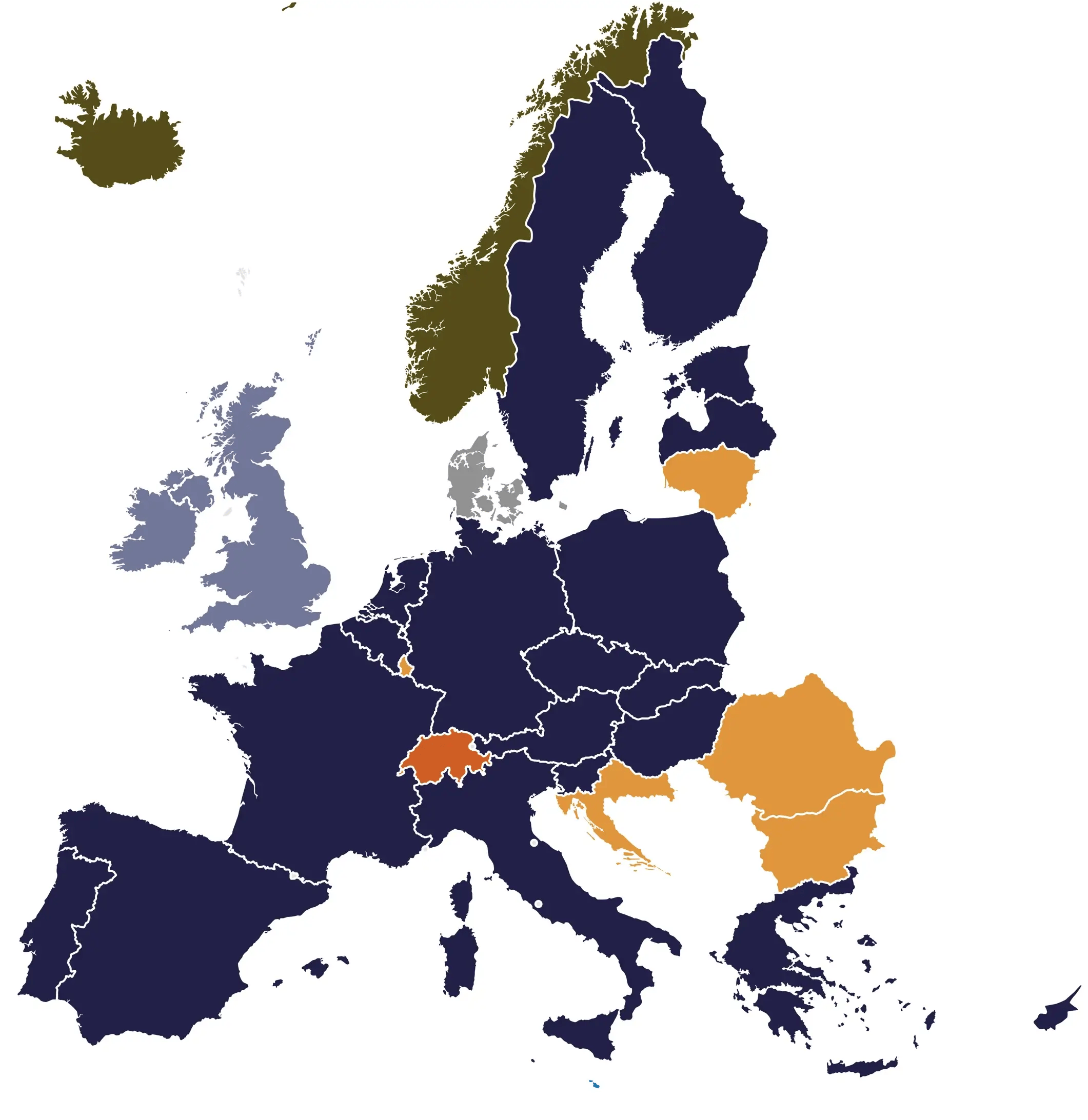

- Lifetime visa-free access to 26 Schengen countries.

- Avoid time-consuming Schengen visa applications.

- Maintain freedom of travel without conflicts with existing citizenship.

Business Benefits

Malta offers a highly attractive environment for businesses and professionals through the MPRP:

- Strategic Location: Malta’s position within the EU, Schengen Area, and Commonwealth provides access to global markets.

- Ease of Business Setup: Simplified processes for establishing businesses make Malta a preferred choice for entrepreneurs.

- Economic Stability: Malta’s robust banking sector and strong economic performance ensure a secure environment for investments.

- Access to the EU Market: Operate in the EU’s largest economic zone, reaching a market of over 500 million people.

- Diverse Investment Sectors: Benefit from opportunities in key industries such as financial services, IT, gaming, tourism, aviation, and maritime.

- Skilled Workforce: Leverage Malta’s multilingual and highly skilled workforce to build and grow businesses.

- Tax Advantages: Attractive corporate tax rates and incentives for foreign investors further enhance Malta’s appeal.

- Infrastructure: Enjoy world-class telecommunications, transshipment facilities, and business support services.

Key Sectors for Investment in Malta

Malta’s economy is diversified, ensuring resilience and growth across various sectors. The 2020 Global Wealth Migration Review highlights that Malta is one of Europe’s success stories, with substantial growth in wealth across industries such as financial services, IT, and real estate. This success further cements Malta as a hub for investment opportunities. Below are some of the notable sectors for investment in Malta.

- Financial Services: Robust regulations and a growing fintech sector.

- Gaming Industry: Malta is a global hub for online gaming companies.

- Information Technology: Increasing investments in AI, blockchain, and IT services.

- Tourism: Record-breaking numbers of visitors, including cruise passengers.

- Aviation and Maritime: Advanced logistics and connectivity.

- Film Industry: Malta’s picturesque locations attract international film productions.

Malta Permanent Residence Programme (MPRP)

What the Malta Permanent Residence Programme Grants

- Eligibility for Long-Term Residency:

-

- The program provides a pathway to apply for long-term residency in Malta.

- Inclusion of Future Family Members:

-

- The principal applicant can add children born or adopted after the approval date, subject to an additional contribution and successful due diligence checks.

- Extension to Dependents:

-

- Allows inclusion of children, spouse, and other direct dependents, also subject to an additional contribution and due diligence checks.

Requirements for the Malta Permanent Residence Programme

- Eligibility:

-

- Must be at least 18 years old.

-

- Must be a non-EU citizen.

- Investment Requirements:

-

- Meet the necessary financial investment requirements.

-

- Maintain and hold the property investment for a minimum of five years.

- Health and Criminal Record:

-

- Maintain good health.

-

- Have a clean criminal record.

- Health Insurance:

-

- Obtain global health insurance coverage.

- Financial Proof:

-

- Provide proof of assets of at least EUR 500,000, including a minimum of EUR 150,000 in financial assets.

-

- Alternatively, prove assets of at least EUR 650,000, with at least EUR 75,000 in financial assets.

With the possibility of applying for multi-generations, the principal applicants’ direct dependents may obtain the same benefits of the Permanent Residency in Malta.

.webp?width=1096&height=2148&name=multi-generation%20(portrait).webp)

Costs of the MPRP

The Malta Permanent Residence Programme (MPRP) offers two investment options, both requiring:

- Government Contribution

- Charitable Donation to a Maltese NGO

- Real Estate Investment (rent or purchase)

Full Contribution Option:

- Government Contribution:

-

- Main applicant: €110,000

-

- Additional dependents (spouse, children, parents, grandparents): €10,000 each

- Charitable Donation: €2,000 to a Maltese registered NGO

- Real Estate Investment: Rent a residential unit for at least €14,000/year for five years

Reduced Contribution Option:

- Government Contribution:

-

- Main applicant: €80,000

-

- Additional dependents (spouse, children, parents, grandparents): €10,000 each

- Charitable Donation: €2,000 to a Maltese registered NGO

- Real Estate Investment: Purchase a residential unit worth at least €375,000 and hold for five years

Malta Permanent Residency Application Process

The Malta Permanent Residence Programme (MPRP) application follows a structured, step-by-step process.

Step 1: Engagement Stage

- Activities:

-

- Initial due diligence checks

-

- Issuance of a letter of engagement

-

- Optional background verification report

- Costs:

-

- Variable costs for professional fees and background verification

Step 2: Compilation and Submission Stage

- Activities:

-

- Collection of required documents

-

- Preparation of forms

-

- Submission of application to the Residency Malta Agency (RMA)

- Costs:

-

- RMA submission fee: €15,000

-

- Variable costs for professional fees

Step 3: RMA Processing Stage

- Activities:

-

- RMA begins due diligence checks

-

- Independent due diligence review

-

- Addressing clarification requests if required

Step 4: Approval Stage

- Activities:

-

- Issuance of approval letter by RMA

-

- Payment of government contributions

-

- Fulfillment of property and other qualifying requirements

- Costs:

-

- Application administrative fee: €50,000 (main applicant) + €10,000 per dependent (spouse, children, parents, grandparents)

-

- Government contribution: €30,000–€60,000 depending on the chosen option

-

- Mandatory NGO donation: €2,000

-

- Real estate investment:

-

-

- Purchase: Minimum €375,000

-

-

-

- Rent: Minimum €14,000/year

-

-

- Health insurance: Variable costs for qualifying medical insurance

Step 5: Malta Permanent Residency Stage

- Activities:

-

- Certificate of residence issued

-

- Biometric data collection in Malta

-

- Malta residency card issuance

Step 6: EU Long-Term Residency

- Eligibility after 5 Years:

-

- Reside in Malta continuously for five years

-

- Provide proof of stable and regular income

-

- Meet integration measures

MPRP Approximate Timeline

While timelines may vary, the overall process can take several months from start to finish, depending on document preparation, due diligence, and approvals.

Pathway to Citizenship Through the Malta Permanent Residence Programme (MPRP)

EU Long-Term Residency (LTR) Rights

Granted after five years of uninterrupted legal stay in an EU state, with a stable income, health insurance, and compliance with integration measures. Benefits include:

- Employment and Business Opportunities: Access to employment and self-employment activities

- Education: Availability of education and vocational training

- Social Benefits: Social protection and core benefits

- EU Mobility: Conditional ability to move to other EU states

Eligibility for Maltese Citizenship

The Maltese Citizenship Act (Cap.188) specifies:

- Residency Requirement:

-

- Reside in Malta for at least five years within seven years before applying.

-

- Must include continuous residency in the twelve months immediately before application.

-

- Reside for a total of four years within the prior six years, apart from the final twelve months.

Achieving citizenship provides access to full EU citizenship rights, offering greater mobility and benefits within the European Union.

Conclusion

The Malta Permanent Residence by Investment Programme offers unparalleled opportunities for families and businesses. With benefits spanning lifestyle, travel, and business, it is a gateway to stability and growth in one of Europe’s most dynamic economies.

Contact Endevio to guide you through the application process and make your journey to Malta seamless. Life in Malta awaits you!

Recent Insights

- Malta Golden Visa vs Portugal: Which Residency Programme in Europe Wins in 2025?

- Malta Citizenship by Merit Reform 2025 | Explained & Analyzed

- Malta Permanent Residency Programme 2025 (MPRP): Europe’s Strongest Golden Visa | Endevio

- Malta Visa-Free & Visa on Arrival Access in 2025: What HNWIs & UHNWIs Need to Know

- Own More Than a Property : How Malta’s Luxury Real Estate Can Secure Your Future